I will file annual report in wyoming state and delaware as a US CPA

Actions

About this gig

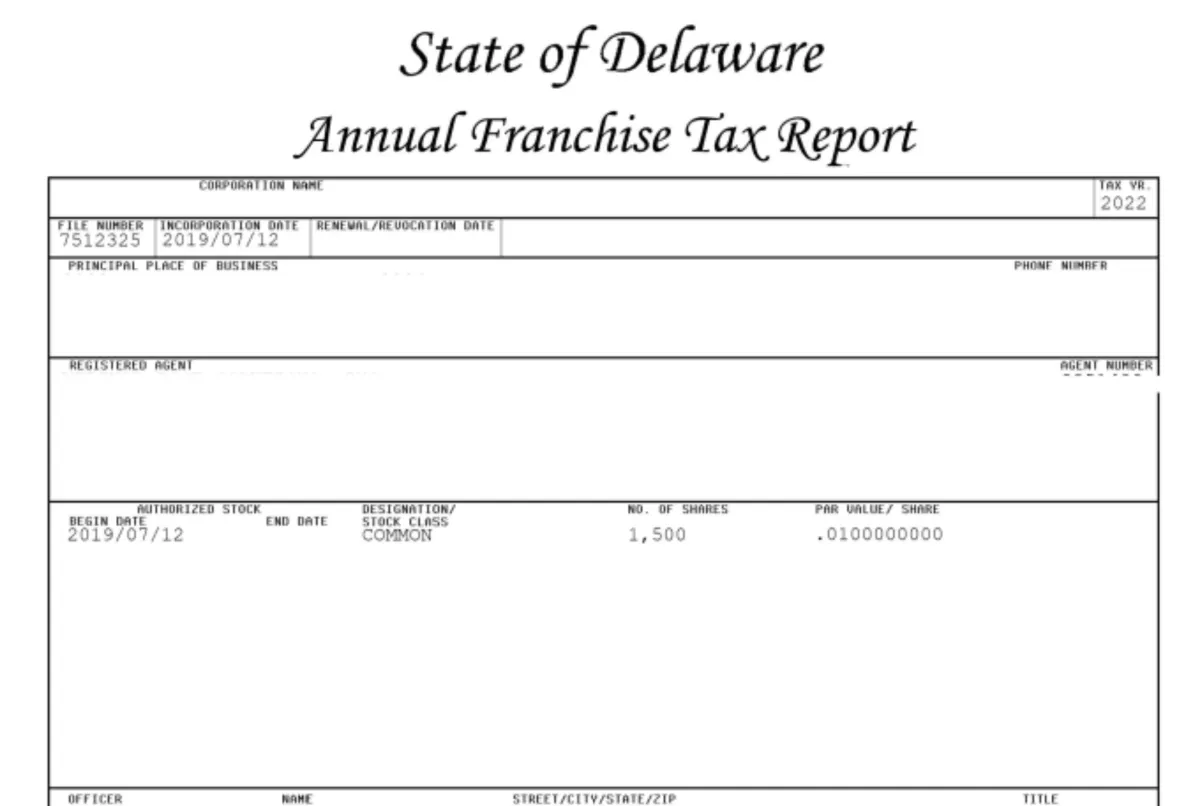

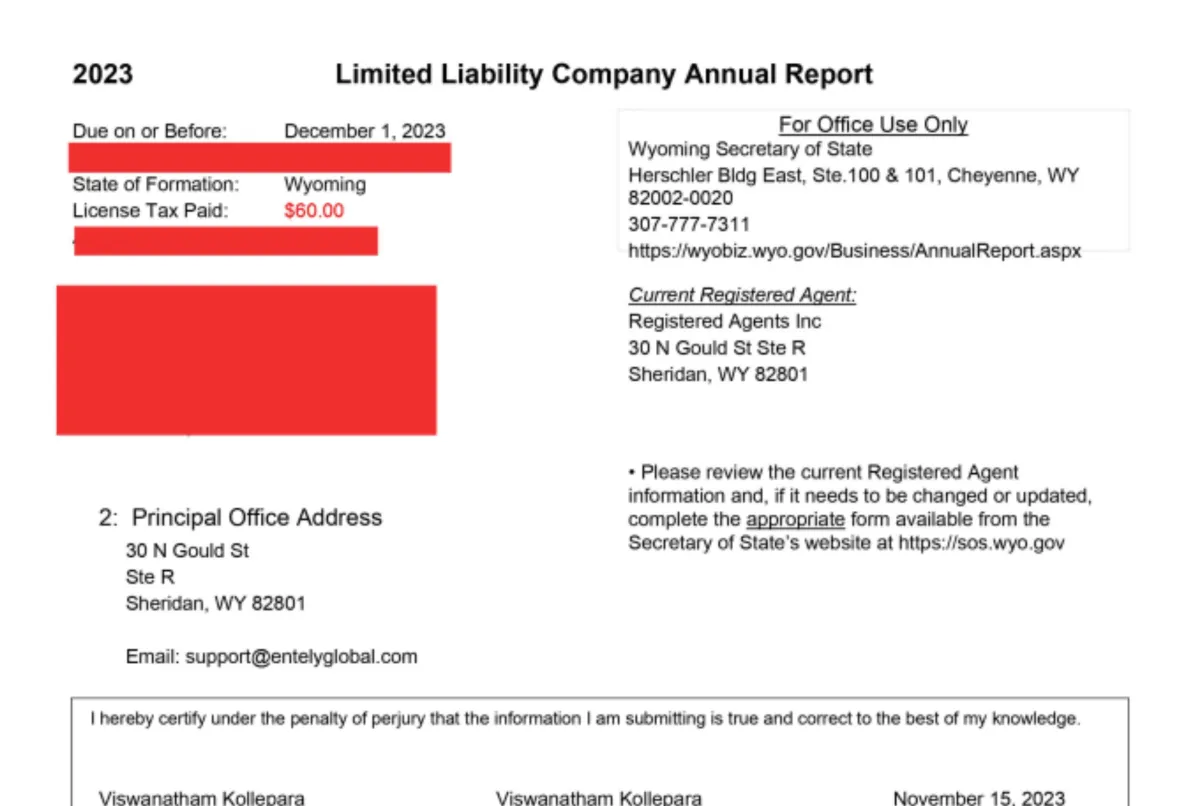

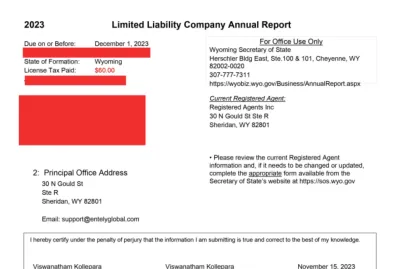

Every LLC or Corp registered in Wyoming or Delaware state needs to file annual reports and pay annual fees to the state to operate the business in the states, this is the fee for doing business. If not done states will dissolve the LLC.

To avoid this we need to file the annual reports and also we can use this filing to update any changes like change in address or changes to registered agent etc

Wyoming has a minimum fee of $62 and Delaware has $300 or $400.00

Wyoming report is due a month before your registration date and Delaware Corporation in March and LLC in June every year.

You may also like the following gigs